are taxes cheaper in arizona than california

CA has some of the highest taxes in the Nation personal income tax rates are roughly double of AZs and Gas taxes are higher also But you do get more benefits. In addition to 911 fees and state USF charges 14 states impose taxes on wireless service that are either in addition to state sales taxes or in lieu of sales taxes but imposed at a higher rate than the state sales tax.

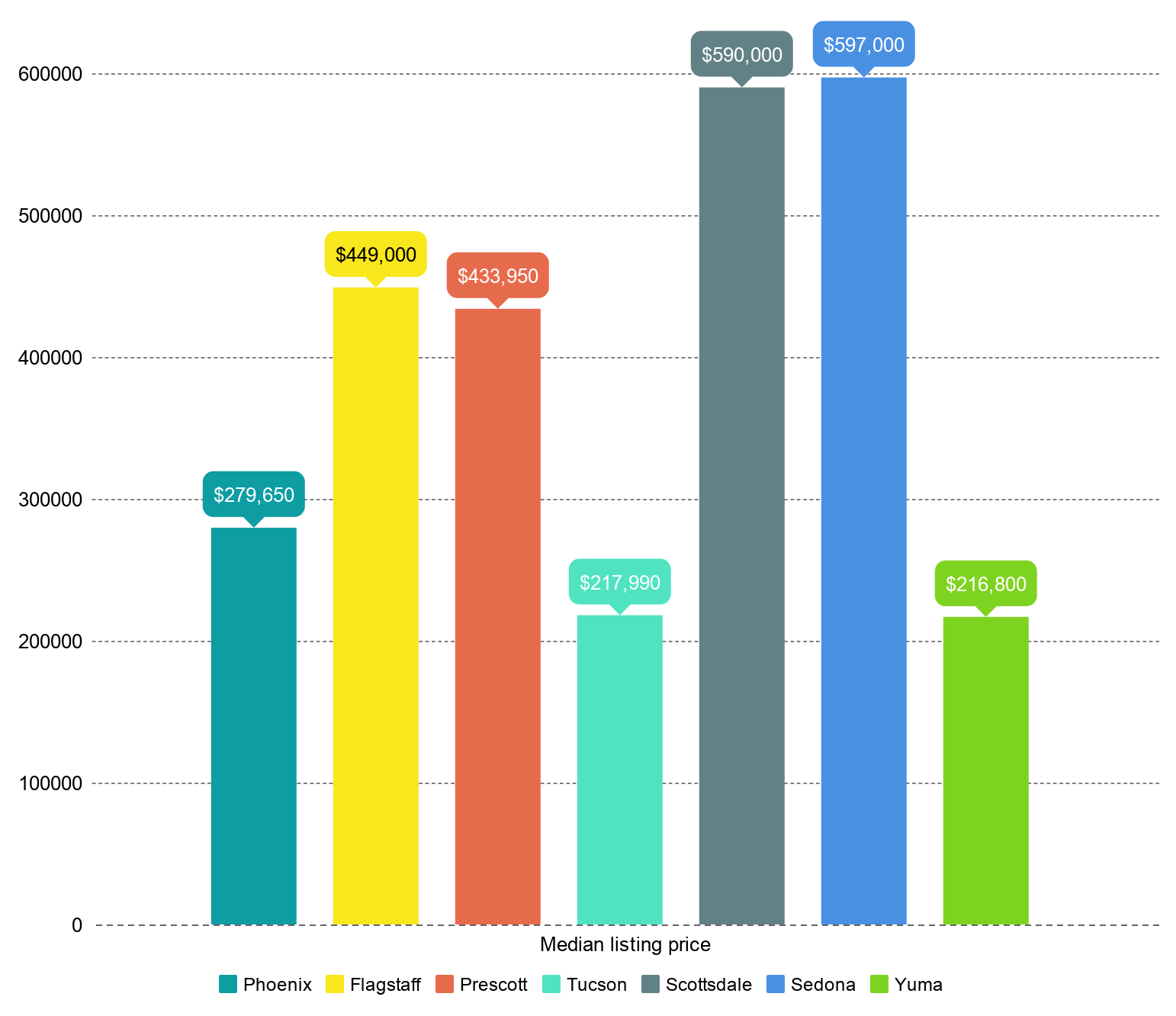

Living In Arizona Versus California Living In Phoenix Az

Furthermore California has some of the highest income tax rates in the country nearly double the state income tax of.

. Overall state tax rates range from 0 to more than 13 as of 2021. Like Arizona California also has a progressive income tax. Residents of the coastal state have to pay almost twice more of the state income tax.

In California single tax filers earning up to 9326 will pay 1 those earning between 9326 and 22107 pay 9325 plus 2 of the amount over the minimum and those earning. California Income Taxes are Twice as Much as Arizona Income Taxes. Table 4 lists these states.

Arizona has cheaper taxes does not demand the pricey blend that California does has a diversified supply of gasoline and has not experienced the recent supply disruptions that have plagued its neighbor to the west. Arizona has the lowest registration fee of 8 but the state adds a 32 public safety fee. Below is a table of each states registration and title fees.

New Hampshires effective tax rate is 218 with Connecticut the only other state with a property tax of over 2 214. I know the property taxes are cheaper in Sun City but Im wondering what other things people are talking about. Californias supply issues began in August when a fire broke out at a Chevron refinery in the Bay Area.

The fact that New Hampshire doesnt have an income tax on wages isnt good for the average taxpayer. Arizona has four total income tax brackets with rates ranging from as low as 259 to as much as 450. Its effective property tax rate is 247 not much higher than the 227 in Illinois.

The rent price is also way higher. 537300 1552 more Utilities. Between the tax relief and lower cost of living we are economically much better off than when we were in CA.

We compare Arizona vs California cost of living. Income Tax Rates In 2022 single taxpayers with incomes of up to 27272 in Arizona will see a 255 income tax rate while those earning more than that will have to pay 298. Are taxes cheaper in Arizona.

Arizona individual income tax rate is 454 while Californians need to pay 93. I just checked and according to the tax Foundation Arizona has the second highest taxes by combining state and sales tax. Are taxes cheaper in Arizona than California.

If you hate the beach you might find Arizona and Nevada to be more attractive than Southern California. So if youre a middle-income person youll pay a smaller portion of your income in state and local tax in Massachusetts than in New Hampshire. So in addition to getting a ton more house for your money in Arizona if you move to Arizona youll save a ton on taxes each and every year you live here.

States may have specific charges in addition to the registration and title fees below. California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in the country and eight states have no tax on earned income at all. None The tax burden in Arizona is small compared to that of other states because of its lower-than-average property taxes so the decline in home prices has hit Arizonas municipalities harder than those in many.

The five states with the lowest top marginal individual income tax rates are. From Bloombergs look at state taxes. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are.

New Hampshire rounds up the list of the top three states with the highest property tax. The largest city in Arizona is Phoenix and it has professional sporting teams restaurants museums and art galleries. Are taxes cheaper in Arizona than California.

This simply means that lower brackets pay lower rates and higher brackets pay higher rates. Therefore you should check your states transportation agency or DMV website when determining the. Instead it relies more on property taxes which arent based on a taxpayers income.

Arizona individual income tax rate is 454 while Californians need to pay 93. Contents1 Is it worth moving to. In December we moved form CA to AZ and have not looked back.

If to compare the average cost of living in Phoenix Arizona and Los Angeles California you will find that CA is far more costlier than AZ. If youre thinking about moving to Arizona or California youve probably checked this cost of living. Another 10 have a flat tax rateeveryone pays the same percentage regardless of how much they earn.

52 rows Texas residents also dont pay income tax but spend 18 of their. State-Level Wireless Taxes. Homeowner No Child care Taxes Not Considered.

State sale tax is also lower in Arizona being 660 in comparison with 725 in. Arizona and Nevada both offer great entertainment options for outdoor lovers. Californias housing cost is 368 costlier.

According to Bloomberg Arizona taxes are much lower than California taxes. Tax Rates in both these states differ greatly. Cost of living California is 293 more expensive than Arizona.

A home of the same size in Los Angeles would cost you 670200The cost of housing utilities transportation and health care are drastically cheaper in Arizona. The state of Arizona has relatively low property tax rates thanks in part to a law that caps the total tax rate on owner-occupied homesThe average effective tax rate in the state is 062 which is well below the 107 national average. Im wondering why people tell me its cheaper for me to live in Sun City than California.

State sale tax is also lower in Arizona being 660 in comparison with 725 in California. 66 Property tax per capita.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

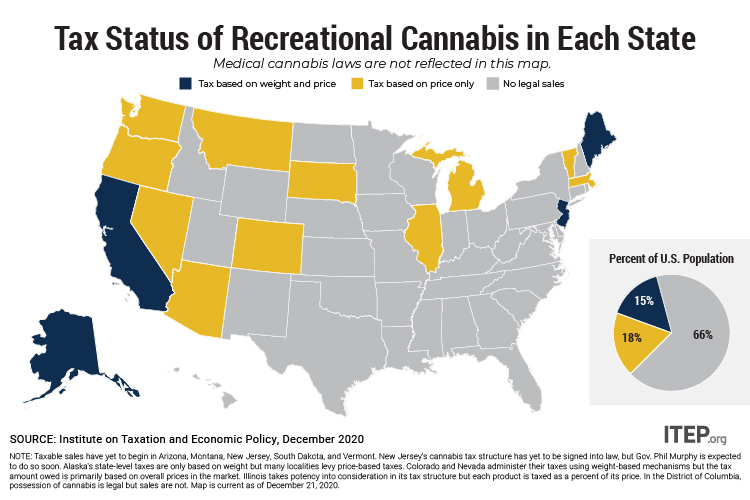

New Jersey Leads By Example With Its New Cannabis Tax Itep

How To Move From California To Las Vegas In 2021 Moving To Las Vegas Las Vegas Visit Las Vegas

How To Move From California To Las Vegas In 2021 Moving To Las Vegas Las Vegas Visit Las Vegas

Get In Touch With Us To Look At Cheap Land For Sale Near Me In California Arizona Land For Sale Mohave County Cheap Land For Sale

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Understanding California S Sales Tax

States With Highest And Lowest Sales Tax Rates

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Understanding California S Sales Tax

How Oklahoma Taxes Compare Oklahoma Policy Institute

Understanding California S Sales Tax

Pros And Cons Of Moving From California To Arizona Californiamoversusa

Where Does Arizona Rank In Cost Of Living Az Big Media

Understanding California S Sales Tax

How To Move From California To Las Vegas In 2021 Moving To Las Vegas Las Vegas Visit Las Vegas

/US_states_by_GDP_per_capita_nominal-f89d1ca278a649a9b47e858ee41e7f09.png)

Cost Of Living In Texas Vs California What S The Difference

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation